Taxes

This section contains options to enable or disable tax settings including Sales Tax, VAT Tax or Custom Tax.

Hide All Tax Fields - If enabled, tax functionality will be removed site wide - including the "My Account" area, "Create Listing" area and on Invoices.

Sales Tax

Sales Tax is primarily a US based system that is calculated depending on the Buyer's Billing Address. The Seller is expected to pay the tax to the state where the buyer resides, based on that state's tax rate.

Sales Tax - Sales Tax will be optionally charged based on buyer's location and tax rates specified by each seller.

Note: The Seller can specify the tax rates from their My Account > Listing Preferences > Taxes page.

Sales Tax applies to Buyer's Premium - If enabled, Sales Tax will be optionally charged based on buyer's location and tax rates specified by each seller

VAT Tax

VAT Tax is primarily an EU based system that allows for a flat rate to be charged across the site.

VAT - VAT tax will be charged on all sale invoices and site fee invoices as configured by admin preferences.

VAT Rate - This percentage tax will be added to invoices as configured below.

VAT applies to Site Fees - If enabled, apply VAT to site fee invoices.

VAT applies to Shipping - If enabled, VAT on sale invoices will include shipping costs.

VAT applies to Buyer's Premium - If enabled, VAT on sale invoices will include buyer's premiums.

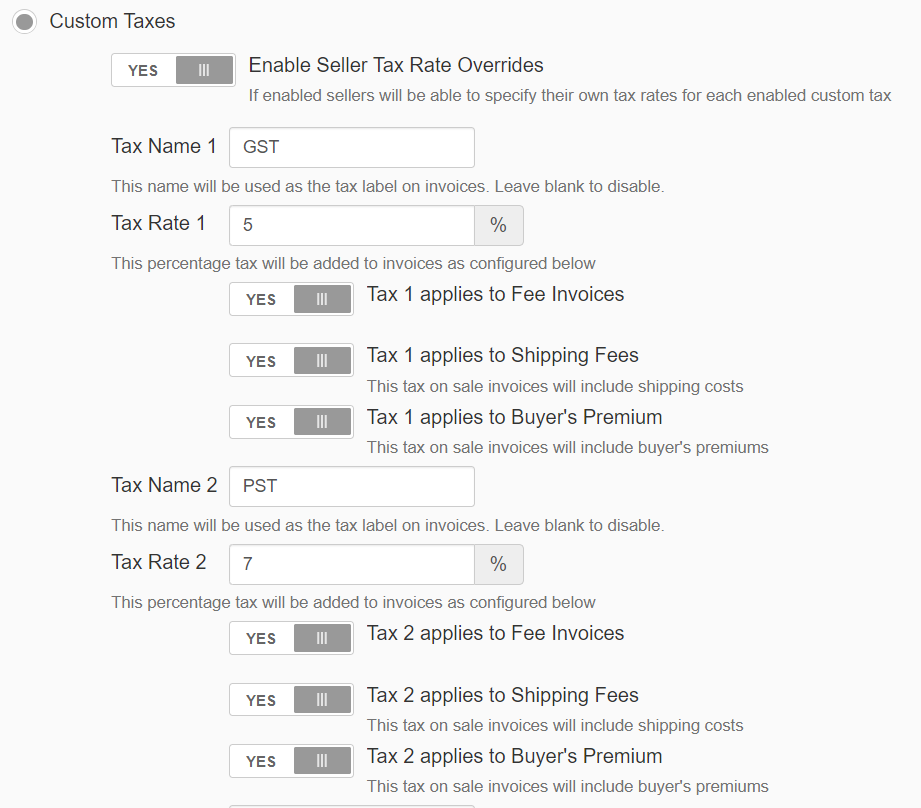

Custom Tax

Custom Tax is a flexible tax system that can incorporate up to 3 tax rates to be applied on a single invoice.

Enable Seller Tax Rate Overrides - If enabled sellers will be able to specify their own tax rates for each enabled custom tax.

Note: The Seller can specify the tax rates from their My Account > Listing Preferences > Taxes page.

Tax Name 1 - This name will be used as the tax label on invoices. Leave blank to disable.

Tax Rate 1 - This percentage tax will be added to invoices as configured.

- Tax 1 applies to Fee Invoices - When enabled, this tax will be applied on Fee Invoices.

- Tax 1 applies to Shipping Fees - When enabled, this tax rate will be applied to Shipping Fees on Sales Invoices.

- Tax 1 applies to Buyer's Premium - When enabled, this tax rate will be applied to the Buyer's Premium on Sales Invoices.

Tax Name 2 - This name will be used as the tax label on invoices. Leave blank to disable.

Tax Rate 2 - This percentage tax will be added to invoices as configured.

- Tax 2 applies to Fee Invoices - When enabled, this tax will be applied on Fee Invoices.

- Tax 2 applies to Shipping Fees - When enabled, this tax rate will be applied to Shipping Fees on Sales Invoices.

- Tax 2 applies to Buyer's Premium - When enabled, this tax rate will be applied to the Buyer's Premium on Sales Invoices.

Tax Name 3 - This name will be used as the tax label on invoices. Leave blank to disable.

Tax Rate 3 - This percentage tax will be added to invoices as configured.

- Tax 3 applies to Fee Invoices - When enabled, this tax will be applied on Fee Invoices.

- Tax 3 applies to Shipping Fees - When enabled, this tax rate will be applied to Shipping Fees on Sales Invoices.

- Tax 3 applies to Buyer's Premium - When enabled, this tax rate will be applied to the Buyer's Premium on Sales Invoices.

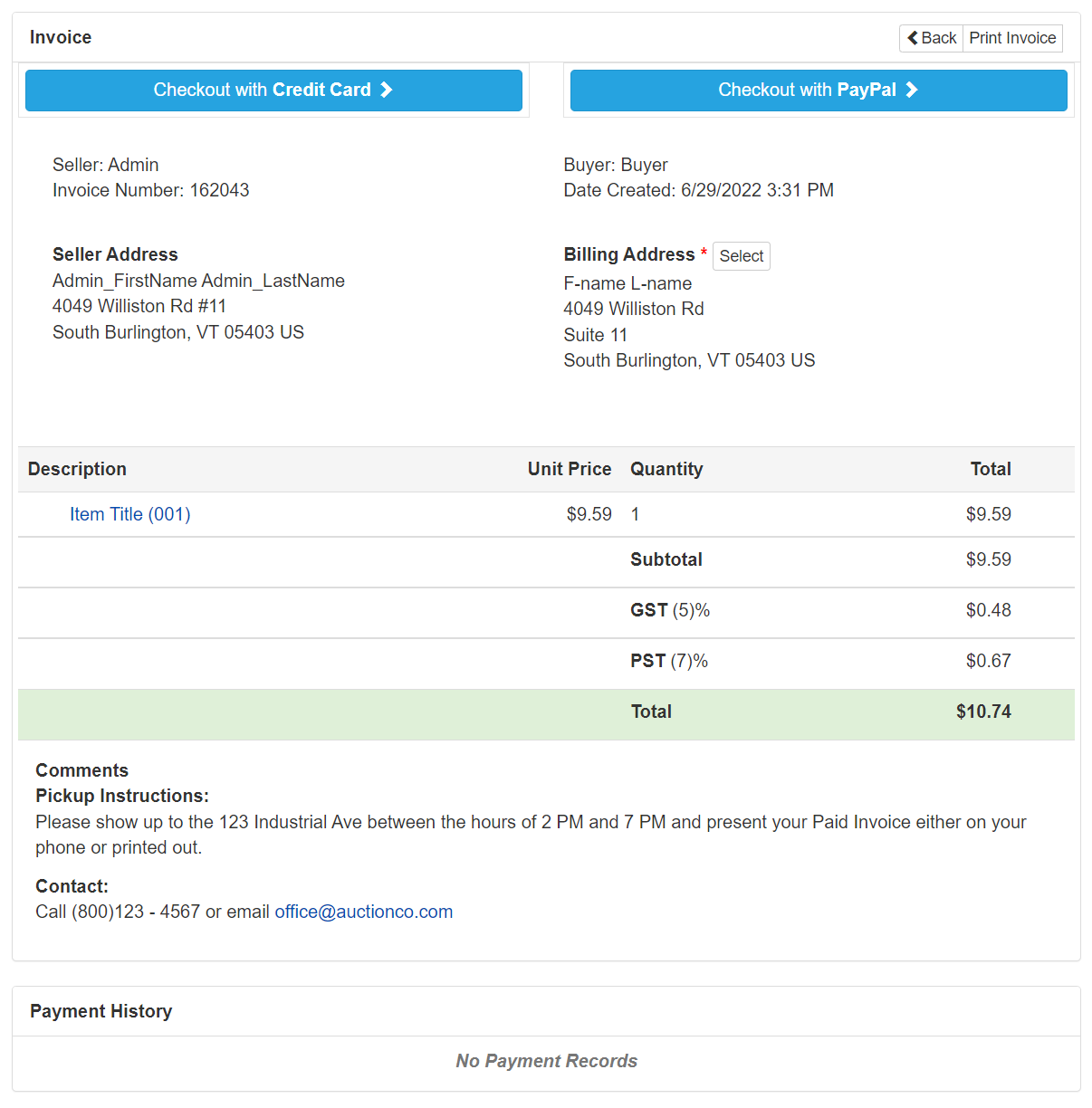

Example Use of Custom Tax

For example, the tax rate in British Columbia, Canada is GST 5% + PST 7%.

To enable this:

- Set the Tax Name 1 to "GST" and the Tax Rate 1 to "5%".

- Then set Tax Name 2 to "PST" and set Tax Rate 2 to "7%".

With these settings a Sales Invoice will look like this: