Invoices (Listings)

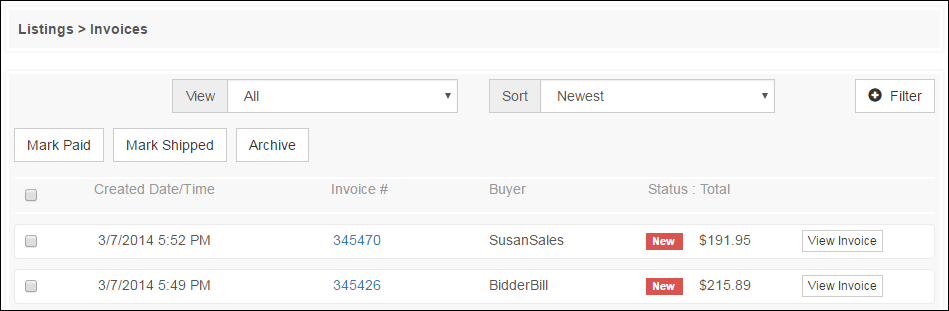

This section displays all of a Seller’s invoices for their sales.

View Invoice - View the invoice details by clicking the "View Invoice" button or by clicking the Invoice # link.

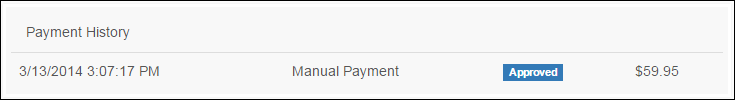

Mark Paid - Mark the checkbox next to invoices and click the Mark Paid button to change their status. This will insert a “Manual Payment” record into the invoice’s payment history.

Example:

Mark Shipped - Mark the checkbox next to invoices and click the Mark Shipped button to change their status, indicating that all items on the invoice have been sent to the buyer.

Archive - Mark the checkbox next to invoices and click the Mark Shipped button to remove the invoices from the All view. The archived invoices can be viewed by selecting Archived from the view menu.

View Options

- All - Display all successful, non-archived, listings.

- Unpaid - Display all Invoices that have not been marked Paid.

- Paid - Display all Invoices that have been marked Paid.

- Not Shipped - Display all of the Invoices that have not yet been marked Shipped.

- Shipped - Display all Invoices that have been marked Shipped.

- Archived - Display only listings that have been archived.

Sorting Options

Click the Sort drop down to change the way the invoices are sorted. Default sorting order lists the newest invoices first.

- Newest - Sort by the invoices from newest to oldest.

- Oldest - Sort by the invoices from oldest to newest.

- Buyer, A to Z - Sort by the invoices by username alphabetically from A to Z.

- Buyer, Z to A - Sort by the invoices by username in reverse alphabetical order from Z to A.

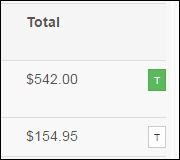

- Total, Low to High - Sort by the invoices by total with the lowest totals at the top.

- Total, High to Low - Sort by the invoices by total with the highest totals at the top.

Filter Options

Click the Filter button to reveal the filter options.

- User - Narrow the results by Username.

- Title - Narrow the results by Title.

- Listing # - Show only the invoices with the listing number entered.

- Invoice # - Show only invoices with the invoice number entered.

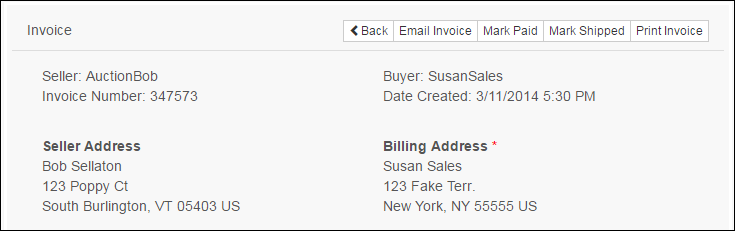

Viewing an Invoice

Click the View Invoice button to review or edit the invoice details, print, or send a copy of the invoice by email to the Buyer.

Back - Navigate back to the list of all sales invoices.

Email Invoice - Sends an email to the Buyer containing the invoice details.

Mark Paid - Clicking the “Mark Paid” button will manually set the invoice status to "Paid" and insert a successful payment record into the invoice’s “payment history”.

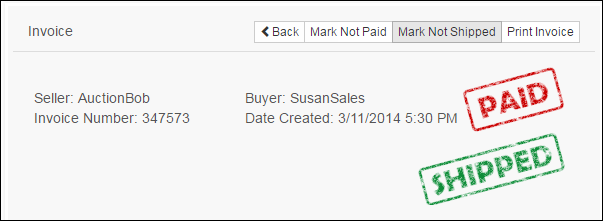

Note: If the invoice is marked “Paid” by accident, the “Paid” status can be reversed by clicking the “Mark Not Paid” button. This button is only displayed when the invoice already has “Paid” status. Marking an invoice as “Not Paid” will insert a payment reversal record into the invoice’s “payment history.”

Mark Shipped - Clicking the “Mark Shipped” button will manually set the invoice status to "Shipped."

Note: If the invoice is marked “Shipped” by accident, the “Shipped” status can be reversed by clicking the “Mark Not Shipped” button. This button is only displayed when the invoice already has “Shipped” status.

Print Invoice - Print a copy of the invoice, including payment history.

Shipping - This drop down menu is based on the shipping options entered when creating the listing.

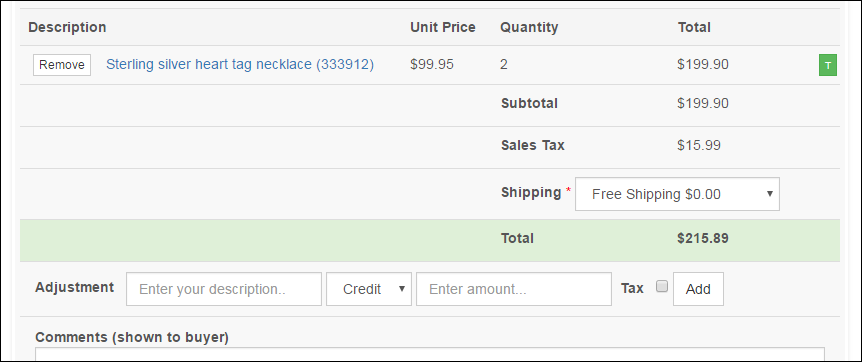

Modify Invoice

Invoices can be customized according to your needs. When editing an invoice, the Seller can add additional credits or debits, manage taxation by line item, and add comments that will be visible to the Buyer.

Note: If VAT is enabled or Taxes are disabled from the Admin Control Panel > Billing and Fees > Taxes page, the invoice will reflect that accordingly.

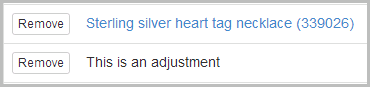

Remove - This button removes the line item from the invoice.

Note: If all items are removed from an invoice, the invoice will be deleted. But, if the Seller allows instant checkout, a new invoice will be generated if the Buyer attempts to checkout.

Tax ( or

or  ) - This is the item's taxation status. Green is on (taxable) and white is off (exempt).

) - This is the item's taxation status. Green is on (taxable) and white is off (exempt).

Note: Taxes will only be calculated if the Buyer is located in a pre-determined taxable location. The Seller can set up their tax settings from the “My Account” menu under “Listing Preferences > Taxes.”

Adjustment - Add a credit or debit manually to the invoice by adding an adjustment.

Description - Describe the adjustment. This will appear on the invoice similar to the listing titles.

Credit/Debit - Determines if the adjustment is a credit or debit.

Note: Examples of a credit that a Seller might add to an invoice: a discount, a partial payment, a credit from a previous purchase or return. Examples of a debit that a Seller might add to an invoice: additional items purchased outside of the website added to the same invoice, additional calculated shipping and handling fees, or a fee for extra services (such as gift wrap).

Amount - The amount of the credit or debit adjustment.

Tax (check box) - Check this box if the adjustment is taxable.

Add - Click this button to add the adjustment to the invoice.

Shipping - This drop down menu is based on the shipping options entered when creating the listing.

Note: If multiple items have the same shipping services available, those items can be added to a single invoice.