Taxes

Manage your tax settings to comply with your tax requirements by county and/or state. These settings will affect your invoice based on the Buyer's shipping address.

Note: The "Taxes" segment will not be available if the Admin Control Panel > Site Preferences > Setup: "Hide All Tax Fields" feature is checked.

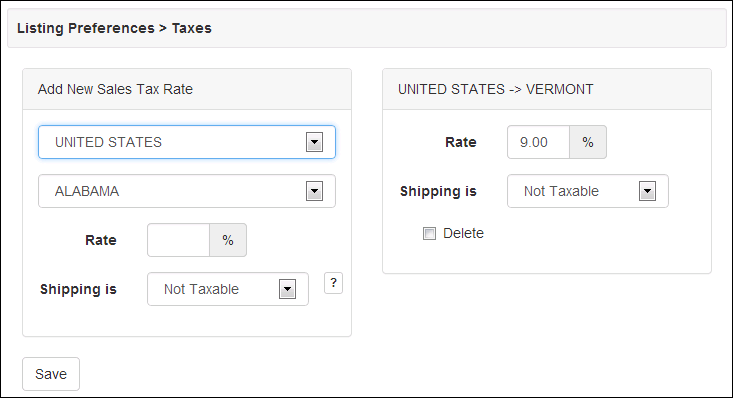

Add New Sales Tax Rate

To add a new tax rate, first choose a country and state/region.

Rate - This is the tax percentage for the country and state/region selected. If the Buyer’s shipping address matches this country state/region, then the tax will be applied on the sales invoice.

Shipping is - This indicates how the actual shipping cost should be taxed.

- Not Taxable - Shipping will not be taxed when this tax rate is used to calculate total sales tax.

- Partially Taxable - A percentage of the shipping cost will be taxable, equivalent to the percentage of taxable item price contributing to the subtotal; e.g. if your invoice has two items, one taxable for $10 and the other not-taxable for $90, then 10% of the shipping cost will be taxed.

- Fully Taxable - The total shipping cost will be taxed.

Delete - Check this box for each tax item you intend to remove and click save.